how to find out why i have a tax levy

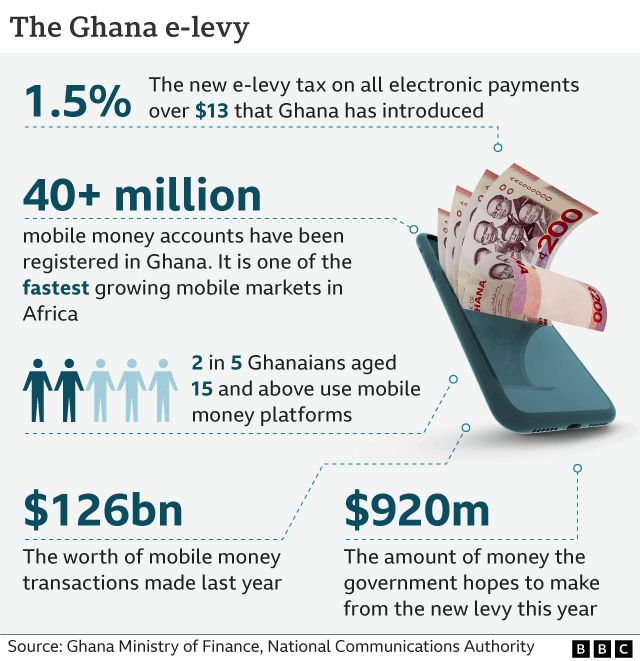

Businesses may contact us at 1-800-829-4933. For example If the dollars per thousand were 10 the tax on a home valued at 50000 would be calculated at 10 x 50.

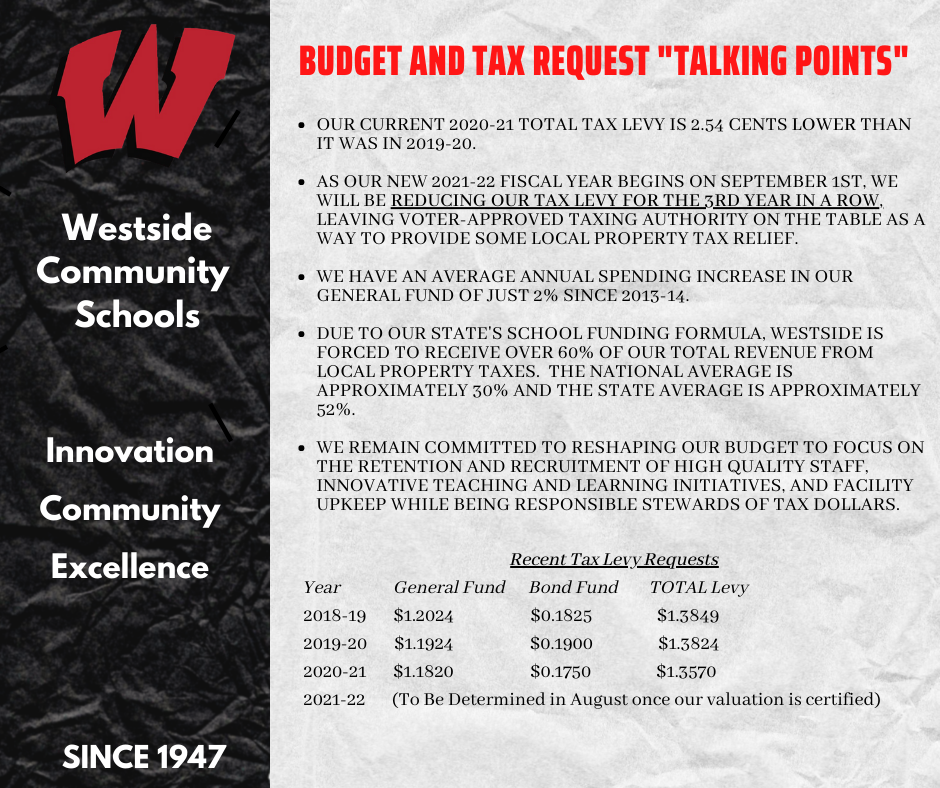

June 25 2021 District Reduces Tax Levy For 3rd Consecutive Year

Tax Tools and Tips.

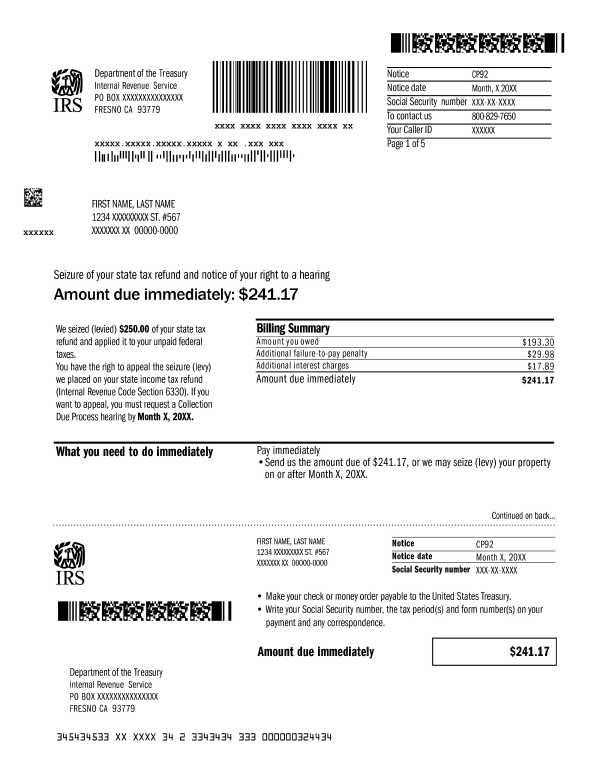

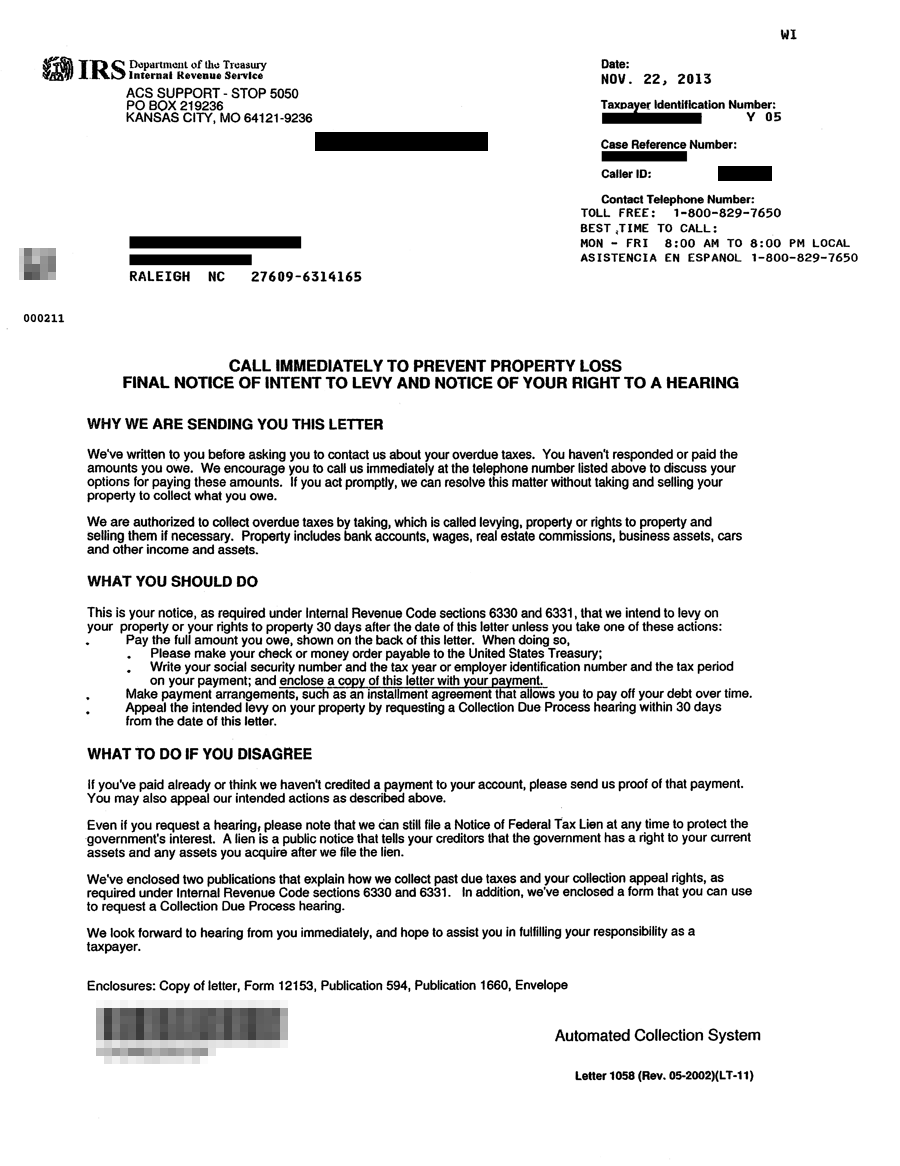

. C all the number on your billing notice or individuals may contact the IRS at 1-800-829-1040. You may have been levied by the state tax authorities or by a creditor if there is an outstanding judgment. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Arrests Bankruptcies Hidden Addresses Phone Numbers. Learn How to Find Out if You Have a Tax Lien. As an employer you have to pay Apprenticeship Levy each month if you.

Apprenticeship Levy is an amount paid at a rate of 05 of an employers annual pay bill. Ad Find Out Everything About Anyone. You may get a reduction or exemption from paying the Medicare levy depending on.

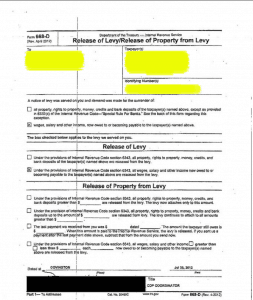

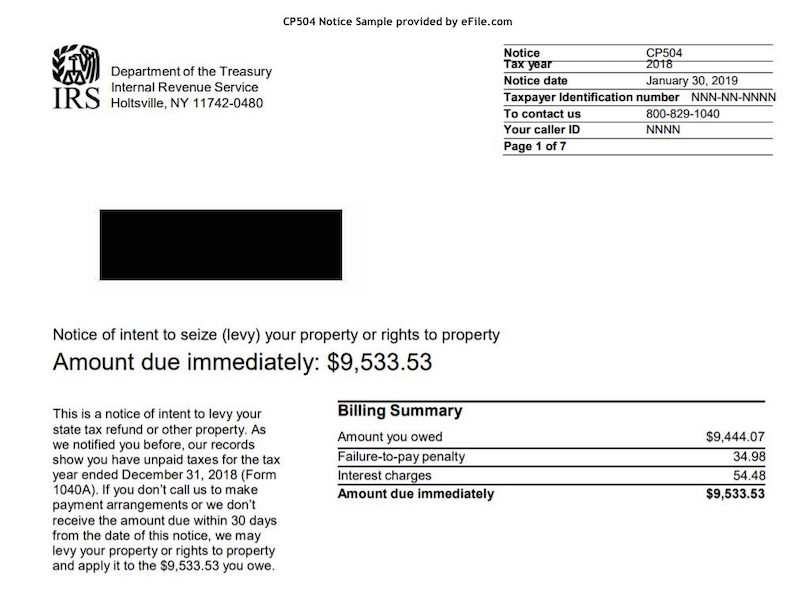

A levy occurs when the unpaid tax debt is owed to the IRS or another institution such as your bank or state. Through a tax levy you may have money taken from your bank. The tax on that home would be 500 for that single taxing authority.

If you have failed to pay enough taxes any taxes at all or failed to file. Get free competing quotes from leading IRS tax levy experts. A simple solution is to open up a separate bank account put your name on it and ask the bank to title the account as an Estimated Tax Account.

Dont Let the IRS Intimidate You. Ad 4 Simple Steps to Settle Your Debt. Free Case Review Begin Online.

Based On Circumstances You May Already Qualify For Tax Relief. While you are at it make sure to get. It is different from a lien while a lien makes a claim to your assets as.

Every time you get paid from a. Check e-file status refund tracker. How do you find out if you have an IRS levy.

Ad Apply for tax levy help now. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Free Case Review Begin Online.

Ad See If You Qualify For IRS Fresh Start Program. Ad See If You Qualify For IRS Fresh Start Program. All tax tips and videos.

A wage levy requires your employer to deduct a specified. See Cell Phone Current Address Email Criminal Offenses Age and More. Complete Edit or Print Tax Forms Instantly.

Call your bank to find out for sure. The Department may levy against your wages salaries bonuses commissions and other compensation from your employer. Based On Circumstances You May Already Qualify For Tax Relief.

The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. A tax levy is a process that the IRS and local governments use to collect the tax money that theyre owed. Tax calculators.

Through a tax lien the IRS legally states that they have the right to claim your property due to unpaid tax debt. Get Free Competing Quotes From Tax Levy Experts.

Irs Form 12153 Request For A Collection Due Process Or Equivalent Hearing

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wisconsin Policy Forum A Growing Divide

Levy Associates Levytaxhelp Twitter

Levies Taxpayer Advocate Service

What Is A Tax Levy Tax Levy Relief Kentucky Bankruptcy Attorneys

What Is A Tax Levy How Stop Levies Free Consultation

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

/https://www.thestar.com/content/dam/localcommunities/renfrew_mercury/news/2022/06/20/renfrew-approves-65-000-tax-levy-on-local-businesses/10294290_DSC_2459.JPG)

Renfrew Approves 65 000 Tax Levy On Local Businesses The Star

Notice Of Public Hearing Maximum Proposed Property Tax Levy City Of Okoboji Okoboji City Hall

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Itr Filing Banks To Check If You Have Filed Itr When Income Crosses Tds Limit From July 1 Levy 2x Tds If Not The Economic Times

Tax Letters Washington Tax Services